Instant Cash Advance App Things To Know Before You Buy

Wiki Article

The Best Personal Loans PDFs

Table of ContentsNot known Incorrect Statements About Instant Loan The Only Guide for Instant LoanThe $100 Loan Instant App DiariesFascination About Instant Cash Advance AppThe Facts About Best Personal Loans RevealedSome Known Factual Statements About Instant Cash Advance App

With an individual financing, you pay fixed-amount installments over a set amount of time till the financial obligation is totally paid back. Before you apply for an individual funding, you should understand some typical financing terms, consisting of: This is the amount you borrow. For instance, if you make an application for a personal car loan of $10,000, that amount is the principal.

Not known Incorrect Statements About Best Personal Loans

APR stands for "annual percentage rate." When you get any kind of funding, along with the rate of interest, the loan provider will generally bill fees for making the car loan. APR integrates both your rate of interest as well as any type of loan provider charges to offer you a much better image of the actual price of your financing.

The variety of months you need to repay the finance is called the term. When a lender authorizes your personal financing application, they'll educate you of the rate of interest rate and also term they're using. Monthly during the term, you'll owe a monthly settlement to the lender. This repayment will consist of money towards paying for the principal of the quantity you owe, as well as a portion of the complete interest you'll owe over the life of the finance.

With a home or auto finance, the actual building you're acquiring works as security to the lending institution. instant cash advance app. An individual funding is generally only backed by the great credit scores standing of the debtor or cosigner. Some loan providers use protected personal financings, which will certainly call for security, and could give better prices than an unsecured funding.

The Single Strategy To Use For $100 Loan Instant App

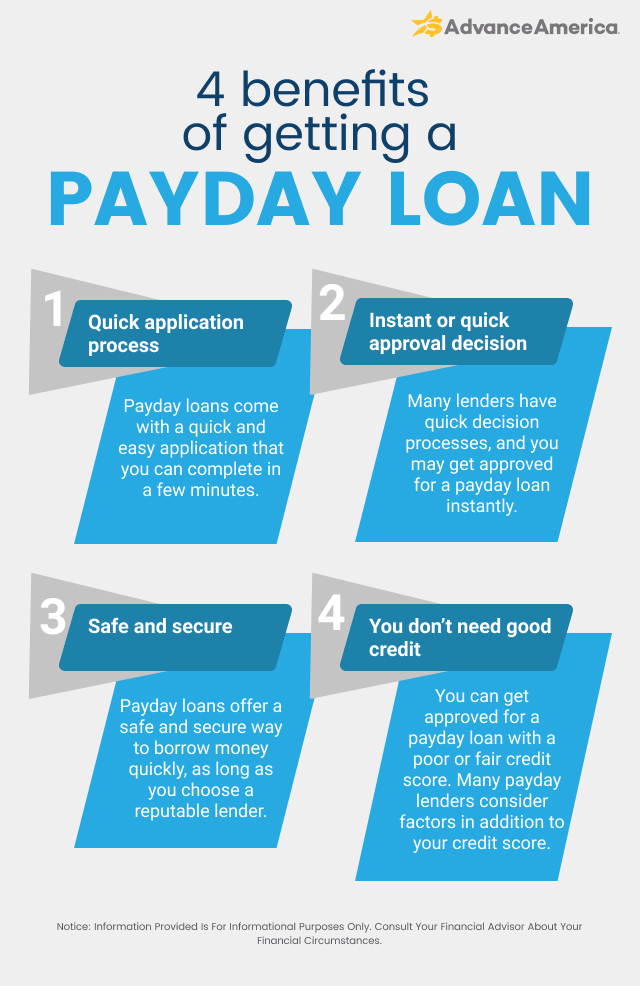

In the brief term, as well lots of difficult questions on your report can have an additional info adverse effect on your credit rating. If you'll be window shopping by relating to greater than one loan provider, be sure to do so in a brief time structure to minimize the influence of difficult queries.On the plus side, a personal financing can aid you make a large acquisition. Breaking a huge expenditure right into smaller payments gradually can aid make that expense much more convenient when you have secure revenue. Personal car loans normally have interest rates that are lower than what you would pay for a credit card purchase.

, and also mix of credit scores kinds. instant loan.

Top Guidelines Of Instant Cash Advance App

When your organization is still young and also expanding, it is most likely that you won't have enough funding to feed its growth to ensure that it can understand its complete possibility. Such are the moments when you will certainly intend to discover your options in regards to financing. Among these alternatives is financial institution loaning.

Prior to you rush to the nearest financial institution, however, it is necessary that you know what the advantages and drawbacks of a financial institution finance are. Large acquisitions, especially those of properties vital to your organization, will become my explanation necessary at some point or other. A bank finance can help in such instances.

What Does Best Personal Loans Mean?

Financial institutions use a large advantage right here since, without them, it would certainly not be easy for lots of people to start companies or expand them. For some, it would be downright impossible. Commonly, when you take a loan from a financial institution, the financial institution does not tell you what you're mosting likely to do with that cash.These will certainly be different from one financial institution to the following and also are normally flexible, allowing you to opt for the terms that favor you one of the most. With the ability to shop about from one bank to one visit their website more and also to work out for far better terms, it's very simple to get a sweet handle a small business loan.

If you obtain a long-term car loan from a bank as well as make every one of your settlements promptly, your credit rating will certainly enhance over the life of the lending. In instance you finish settling the whole car loan promptly without any type of missed settlements, your credit rating will in fact boost.

$100 Loan Instant App Things To Know Before You Buy

The majority of business car loans are protected, which means something is backing the funding. If the funding is secured by security, after that the financial institution can assert some asset of yours or your business in the occasion that you can not pay back the finance.Report this wiki page